Arizona LLC Operating Agreement

Every Arizona LLC should have an operating agreement in place.

While not legally required by the state, having a written operating agreement will set clear rules and expectations for the management and operations of your LLC.

Download our free Arizona operating agreement template below or sign up to create a custom operating agreement using our free tool.

Forming an LLC? Get a free operating agreement when you use Northwest to start an LLC for $29 (plus state fees).

Free Arizona LLC Operating Agreement Templates

We offer operating agreement templates for single-member LLCs and multi-member LLCs (including member-managed and manager-managed) as well as a customizable operating agreement tool.

Single-Member LLC Operating Agreement

Our single-member LLC operating agreement template was created for limited liability companies with only one member, where the sole member has full control over all affairs of the LLC and no other individuals have a membership interest in the company.

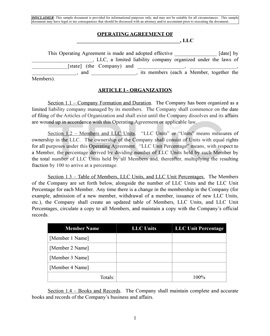

Multi-Member LLC Operating Agreements

Our multi-member LLC templates are meant for LLCs with more than one member. There are two types available: manager-managed and member-managed.

Create Custom Operating Agreement

Create a custom operating agreement using our free tool. Just answer a few basic questions, and the tool will develop an operating agreement for your new LLC.

To use our tool, you will need to sign in to our Business Center. A Business Center account will also grant you access to many other free tools, special discounts on business services, and much more.

What Is an Arizona LLC Operating Agreement?

Subscribe to our YouTube channel

An operating agreement is a legal document that outlines the ownership structure and operating procedures of an LLC.

Whether you are starting a single-member or multi-member LLC, your operating agreement should address all of the topics below. Some of these stipulations will not have much bearing on the actual operations of a single-member LLC, but are still important to include for the sake of legal formality.

- Organization: When the LLC was officially formed, who its members are, and how ownership is divided. Multi-member LLCs may utilize an equal ownership structure or assign various members different “units” of ownership.

- Management & Voting: Whether the LLC will be managed by its members or by an appointed manager, and how members will go about voting on business matters. Typically, each member has one vote, but you may wish to give some members more voting power than others. For more information on managing your LLC, read our Member-Managed vs Manager-Managed guide.

- Capital Contributions: The amount of money each member has invested in the business. This is also where you should establish an approach to raising additional funds in the future.

- Distributions: How profits and losses will be divided among the members. The most common option is to distribute profits evenly. If you want them divided a different way, this should be detailed in your operating agreement. For more information on the basics of LLC ownership, read our Contributions and Distributions guide.

- Changes to Membership Structure: How roles and ownership will be transferred in the event that a member leaves the company. It’s essential to lay out the process for buying out and/or replacing a member in the LLC’s governing document.

- Dissolution: Dissolution: If at some point all the members of your LLC decide you no longer wish to conduct business, you should officially dissolve it. Outlining the hypothetical process of dissolving your business is an important aspect of your operating agreement. To learn how to dissolve your Arizona LLC, read our Arizona LLC Dissolution article.

We reviewed the top LLC services. Find which service is right for you.

Ready to Form an LLC?

Get a free operating agreement when you form an LLC with Northwest ($29 plus state fees).

Why Should I Have an Arizona LLC Operating Agreement?

No matter what type of Arizona LLC you're starting, you'll want to create an operating agreement. Here's why:

-

It’s recommended by the state. According to Arizona Revised Statutes § 29-3105, every Arizona LLC may adopt an operating agreement to govern the company’s operating procedures.

- It'll prevent conflict among your business partners. If you're starting a multi-member LLC, having an operating agreement will prevent misunderstandings amongst your team by setting clear expectations about each partner's role and responsibilities.

- It helps preserve your limited liability status. If you're the sole owner of a single-member LLC in Arizona, having an operating agreement will help to ensure your limited liability status is upheld by court officials, and add to your business's credibility as a whole.

The full text of the statute can be found below:

A. Except as otherwise provided in subsections C and D of this section:

1. The operating agreement governs all of the following:

(a) Relations among the members as members and between the members and the limited liability company.

(b) The rights and duties under this chapter of a person in the capacity of manager.

(c) The activities and affairs of the company and the conduct of those activities and affairs.

(d) The means and conditions of amending the agreement.

2. The operating agreement may contain any provision that is not contrary to law.

3. In the event of a conflict between a provision of the operating agreement and this chapter, the provision of the operating agreement governs.

B. To the extent the operating agreement does not provide for a matter described in subsection A of this section, this chapter governs the matter.

C. An operating agreement may not:

1. Vary the law applicable under section 29-3104.

2. Vary a limited liability company's capacity under section 29-3109 to sue and be sued in the limited liability company's own name.

3. Vary any requirement, procedure or other provision of this chapter pertaining to:

(a) Statutory agents.

(b) The commission, including provisions pertaining to records authorized or required to be delivered to the commission for filing under this chapter.

4. Vary the provisions of section 29-3204.

5. Eliminate the contractual obligation of good faith and fair dealing or the duty to refrain from wilful or intentional misconduct under section 29-3409.

6. Limit or eliminate a person's liability for any violation of the contractual obligation of good faith and fair dealing or conduct involving wilful or intentional misconduct.

7. Unreasonably restrict the duties and rights of members and managers under section 29-3410, but the operating agreement may impose reasonable restrictions on the availability and use of information obtained under section 29-3410 and may define appropriate remedies, including liquidated damages, for a breach of any reasonable restriction on use.

8. Vary the causes of dissolution specified in section 29-3701, subsection A, paragraph 4, subdivision (b) and section 29-3701, subsection A, paragraph 5.

9. Unreasonably restrict the right of a member to maintain an action under article 8 of this chapter, except that the operating agreement may require a member maintaining a direct action under section 29-3801 to plead and prove an actual or threatened injury that is not solely the result of any injury suffered or threatened to be suffered by the company.

10. Vary the provisions of section 29-3805, but the operating agreement may provide that the company may not have a special litigation committee.

11. Vary the required contents of a plan of merger, a plan of interest exchange, a plan of conversion, a plan of domestication or a plan of division under article 10 of this chapter.

12. Except as otherwise provided in section 29-3106 and section 29-3107, subsection B, restrict the rights under this chapter of a person other than a member or manager.

13. Reduce or eliminate, in a manner that adversely affects the rights of a person other than a member or manager, the restrictions on distributions under section 29-3405 or the liabilities for prohibited distributions under section 29-3406.

14. Vary the requirements of section 29-3108, subsection C or D.

D. Subject to subsection C, paragraphs 5 and 6 of this section, without limiting other terms that may be included in an operating agreement, the following apply:

- To the extent that, at law or in equity, a member or manager or other person has duties, including the duty of care, the duty of loyalty and any other fiduciary duty, to a limited liability company, to another member or manager or to another person that is a party to or is otherwise bound by an operating agreement, the member's, manager's or other person's duties may be expanded, limited or eliminated by the operating agreement.

- An operating agreement may provide for the limitation or elimination of any or all liabilities for breach of the operating agreement or breach of duties, including the duty of care, the duty of loyalty and any other fiduciary duty, as expanded, limited or eliminated in the operating agreement, of a member, manager or other person to a company or to another member or manager or another person that is a party to or is otherwise bound by the operating agreement.

- An operating agreement may specify a method by which a specific act, omission or transaction, or a specific category of acts, omissions or transactions, that would otherwise violate a duty, including the duty of care, the duty of loyalty and any other fiduciary duty, as expanded, limited or eliminated in the operating agreement, may be authorized or ratified. A general provision in an operating agreement that provides for management by one or more members or managers, without more, is not sufficient to specify a method for authorization or ratification under this paragraph.

- An operating agreement may specify a method by which a member, manager or other person may be reimbursed, indemnified or held harmless, or by which the liability of a member, manager or other person may be limited or eliminated, for a specific act, omission or transaction, or a specific category of acts, omissions or transactions, that would otherwise violate a duty, including the duty of care, the duty of loyalty and any other fiduciary duty, as expanded, limited or eliminated in the operating agreement. A general provision in an operating agreement that provides for management by one or more members or managers, without more, is not sufficient to specify a method for reimbursing, indemnifying or holding harmless a person or limiting or eliminating a person's liability under this paragraph.

E. Subject to the limitations of subsection C, paragraphs 5 and 6 of this section, an operating agreement may define some or all of the fiduciary duties of a member, manager or other person that is a party to or is otherwise bound by an operating agreement to be the same as the fiduciary duties of a director, officer or shareholder of a corporation formed under the laws of this state, in which case, unless the operating agreement provides otherwise, all laws of evidence and evidentiary presumptions and other laws that apply to the fiduciary duties of a director, officer or shareholder of a corporation formed under the laws of this state apply to such duties.

After Creating Your Arizona LLC Operating Agreement

Once you have finished your operating agreement, you do not need to file it with your state. Keep it for your records and give copies to the members of your LLC.

Following any major company event, such as adding or losing a member, it is a good idea to review and consider updating the operating agreement. Depending on how your operating agreement is written, it may require some or all of the members to approve an amendment to the document.

Get a Free Operating Agreement

Create a free account with our Business Center to access operating agreement templates and dozens of other useful guides and resources for your business.

INSTRUCTIONS: Create your business center account. After logging in, scroll down to "TOOLS" and select "Free Legal Forms".

Frequently Asked Questions

Yes. Although you won’t file this document with the state, having an operating agreement in place is the best way to maintain control of your Arizona LLC in the face of change or chaos.

While it's a good idea to create an operating agreement before filing your Articles of Organization, the state does not discourage LLCs from waiting until the formation process is complete. It's worth noting that some banks require you to submit an operating agreement in order to open a business bank account.

No. Operating agreements are to be retained by the LLC members. The Arizona Corporation Commission does not accept operating agreements that are sent to them.