How to Start an LLC in Maine (2024 Guide)

Wondering how to start an LLC in Maine? We’ve got you covered.

To get started, you'll need to pick a suitable business name, choose a registered agent, and file your Certificate of Formation with the Maine Secretary of State ($175 processing fee).

You can do this independently, consult with a business attorney for specialized legal guidance, or join the other 65% of our readers and hire a specialized Maine LLC formation service (recommended).

How to Form an LLC in Maine in 6 Steps

In order to form your LLC in Maine, you will need to complete the following steps:

- Name Your LLC

- Choose a Registered Agent

- File Your Certificate of Formation

- Create Your Operating Agreement

- Obtain an EIN

- File a Beneficial Ownership Information Report

Step 1: Name Your Maine LLC

Before you get started, you will need to pick a suitable name for your Maine LLC.

This will need to comply with all applicable Maine naming requirements and be both succinct and memorable, as this will make it easily searchable by your potential clients.

1. Important Naming Guidelines for Maine LLCs:

- Your name must include the phrase “limited liability company” or one of its abbreviations (e.g., LLC. L.L.C, etc.). In the case of a low-profit LLC, the phrase "L3C" or "13c" must be included instead.

- Your name cannot include words that could confuse your LLC with a government agency (e.g., FBI, Treasury, State Department, etc.).

- Your name must be distinguishable from any other Maine limited liability company, corporation, limited liability partnership or limited partnership.

- When considering the uniqueness of your LLC’s name, it will disregard certain elements, including entity type descriptors, the use or omission of "and" and "the," and variations in punctuation, capitalization, or special characters.

- Prohibited words and phrasing include obscene language, promote abusive or unlawful activities, or falsely suggest an association with public institutions.

For a complete list of naming rules in Maine, we recommend checking out Maine's official Naming Guidelines.

2. Is the name available in Maine?

To check whether your desired name is already taken by another business entity in Maine, you can perform a Business Entity Search on the Maine Secretary of State website.

If you’re not going to start your LLC right away, it might be a good idea to consider reserving your name for up to 120 days.

For more information, you can have a look at our Maine LLC Name Search guide.

3. Is the URL available?

We recommend that you check online to see if your business name is available as a web domain. Even if you don't plan to make a business website right away, this is an extremely important step as it will prevent others from acquiring it — potentially saving you both time and money in the long term.

Once you have verified your name is available, you may now select a professional service to complete the LLC formation process for you.

Subscribe to our YouTube channel

We reviewed and ranked the best LLC services. Find out which is best for you.

FAQ: Naming a Maine LLC

LLC is short for “limited liability company.” It is a simple business structure that offers more flexibility than a traditional corporation while providing many of the same benefits. Read our What is a Limited Liability Company guide for more information.

Or, watch our two-minute video: What is an LLC?

You must follow the Maine LLC naming guidelines when choosing a name for your LLC:

- Include the phrase "limited liability company" or one of its abbreviations (LLC or L.L.C.).

- Do not use words that could confuse your business with a government agency (FBI, State Department, CIA, etc.).

- Receive the proper licensing when using the words such as lawyer or doctor.

If you are having trouble coming up with a name for your LLC, use our LLC Name Generator. That will not only find a unique name for your business but an available URL to match.

Most LLCs do not need a DBA, known as an assumed name in Maine. The name of the LLC can serve as your company’s brand name and you can accept checks and other payments under that name as well. However, you may wish to register a DBA if you would like to conduct business under another name.

To learn more about DBAs in your state, read our How to File a DBA guide.

Step 2: Choose a Registered Agent in Maine

After you find the right name for your LLC, you will need to nominate a Maine registered agent. This is a necessary step in your Certificate of Formation (i.e., the document used to file and register your LLC with the Secretary of State).

What is a registered agent? A registered agent is an individual or business entity responsible for receiving important legal documents on behalf of your business. You can think of your registered agent as your business's primary point of contact with the state.

Who can be a registered agent? A registered agent must be a resident of Maine or a corporation — such as a registered agent service, an individual in your company (e.g., yourself, etc.), or a business attorney — that is authorized to transact business in Maine.

Keep in mind that the SOS’s Bureau of Corporations, Elections, and Commissions offers a commercial registered agent online listing service, which you can use to find a Maine registered agent for your business.

Get Free Registered Agent Services

Form an LLC with Northwest Registered Agent to get one year of registered agent services free of charge.

FAQ: Nominating a Registered Agent

Yes. You or anyone else in your company can serve as the registered agent for your LLC. Having said that, this usually isn’t recommended for small business owners as a registered agent service will maintain your privacy and save you time.

Read more about being your own registered agent.

Using a professional registered agent service is an affordable way to manage government filings for your LLC. For most businesses, the advantages of using a professional service significantly outweigh the annual costs.

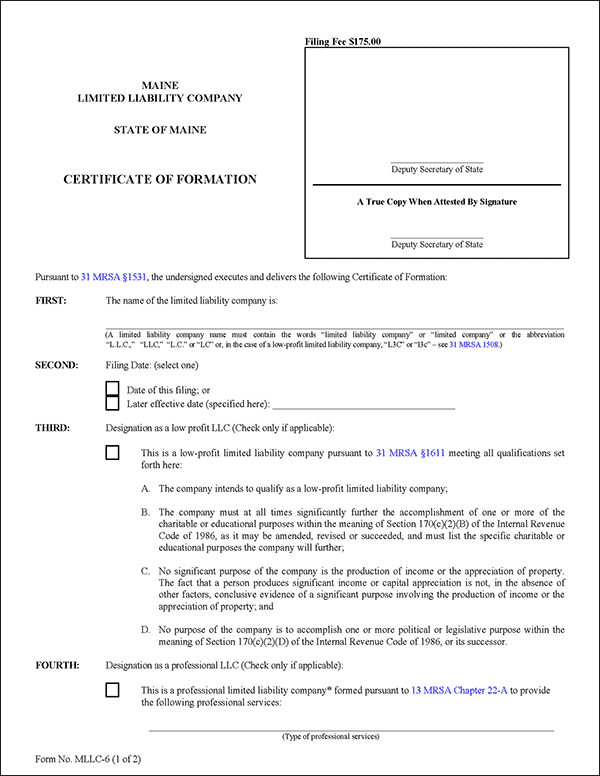

Step 3: File the Maine LLC Certificate of Formation

To register your Maine LLC, you will need to file Form MLLC-6: Certificate of Formation with the Secretary of State. You can only apply by mail.

Before filing, you’ll need to have certain information on hand to be able to complete your Certificate of Formation correctly, including:

- The name of your LLC

- The date of filing or effective later date (if applicable)

- Whether You’ll Elect as a Low-Profit LLC

- Your Professional LLC Election (if applicable)

- The name of your registered agent (either commercial or noncommercial)

- Any special handling requests (e.g., 24-hour expedited filing, immediate filing, attested copy, etc.).

File the Certificate of Formation

File Form MLLC-6 by Mail With the Maine Secretary of State

Download FormFee: $175, payable to the Maine Secretary of State (Nonrefundable)

Mailing Address:

Secretary of State

Division of Corporations, UCC and Commissions

101 State House Station

Augusta, ME 04333

For help with completing the form, visit our Maine Certificate of Formation guide.

Note: If you're expanding your existing LLC to the state of Maine, you will need to form a foreign limited liability company (LLC).

FAQ: Filing Maine LLC Documents

It typically takes between 25 and 30 business days for LLC filings to be processed by the Maine Secretary of State. Keep in mind that this may be expedited for an additional fee ($50 for 24 hour filings and $100 for same business day filings).

An LLC is referred to as a "domestic LLC" when it conducts business in the state where it was formed. A foreign LLC must be formed when an existing LLC wishes to expand its business to another state.

Read our What Is a Foreign LLC article to learn more.

The cost to start a Maine LLC is $175.

To learn more, read our guide on the cost to form a Maine LLC.

Step 4: Create a Maine LLC Operating Agreement

Maine’s default LLC statutes require LLCs to form an operating agreement per Revised Statutes Section 1531.1.B of the state's legal code.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC. Maine refers to the operating agreement as the limited liability company agreement.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our Maine LLC operating agreement.

FAQ: Creating a Maine LLC Operating Agreement

No. Though Maine law requires LLCs to create and maintain an operating agreement, an operating agreement is an internal document that you should keep on file for future reference.

Step 5: Get a Maine LLC EIN

You can get an Employer Identification Number (EIN) from the IRS for free. It is used to identify a business entity and keep track of a business’s tax reporting. It is essentially a Social Security number (SSN) for the company.

Why do I need an EIN? An EIN number is required for the following:

- To open a business bank account for the company

- For federal and state tax purposes

- To hire employees for the company

Where do I get an EIN? An EIN is obtained from the IRS (free of charge) by the business owner after forming the company. This can be done online or by mail.

FOR INTERNATIONAL APPLICANTS: You do not need an SSN to get an EIN. Learn more here.

Get an EIN

Option 1: Request an EIN from the IRS

- OR -

Option 2: Apply for an EIN by Mail or Fax

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

FAQ: Getting an EIN

An SSN is not required to get an EIN. You can simply fill out IRS Form SS-4 and leave section 7b blank. Then call the IRS at (267) 941-1099 to complete your application. Learn more here about applying as an international applicant.

All LLCs with employees, or any LLC with more than one member, must have an EIN. This is required by the IRS.

Learn why we recommend always getting an EIN and how to get one for free in our Do I Need an EIN for an LLC guide.

When you get an EIN, you will be informed of the different tax classification options that are available. Most LLCs elect the default tax status.

However, some LLCs can reduce their federal tax obligation by choosing the S corporation (S corp) status. To learn more, read our LLC vs. S Corp guide.

Step 6: File a Beneficial Ownership Information Report

Beginning January 2024, LLC owners will need to file a Beneficial Ownership Information (BOI) Report with the US Financial Crimes Enforcement Network (FinCEN). Existing LLCs can file their report any time between January 1, 2024, and January 1, 2025, while new LLCs will need to file their report within 90 days of formation.

This contains similar information to that of your Articles of Organization, such as your LLC name and member information, and can be filed online for free. Failure to file an accurate report on time can result in a $500 per day fine.

Note: There are certain filing exemptions, such as for large companies (i.e., more than 20 full-time employees), tax-exempt entities, and publicly traded companies.

Considering Using an LLC Formation Service?

We reviewed and ranked the top LLC formation services. Find out which is best for you.

BEST LLC SERVICESMaintain Your Maine LLC

After you’ve successfully formed your LLC, there are a couple of steps you’ll need to periodically take in order to maintain it, including:

- Filing an annual report

- Sorting out your tax requirements

We’ve provided more information on how to complete each of these steps below.

File an Annual Report

In Maine, maintaining good standing as an LLC involves submitting an annual report and $85 filing fee to the Secretary of State. Maine LLC annual reports must be submitted by June 1 of each year, either by mail or online.

You can easily file online by using the Maine Secretary of State's website, which provides instructions on the filing process. Alternatively, you can download the Maine LLC annual report form from this website and mail it to the specified address once you’ve filled it out with your LLC's information.

Note: Whether you choose to file online or by mail, ensuring your annual report is accurate and submitted on time is key in order to avoid penalties.

Sort Out Your Taxes

LLCs in Maine will need to pay a number of taxes at a local, state, and federal level. With that said, the taxes your LLC must pay will vary depending on the nature of your business (e.g., its industry, niche, and number of employees, etc.).

Below, we’ve broken down the most common taxes in Maine that your LLC may be expected to pay:

Income Taxes

As is the case in many other states, your LLC will be liable to pay income tax at a state level, which is required in addition to its federal income tax obligations. The two main types of state income tax you may need to pay in Maine are:

- Personal Income Tax: This is set at a gradual rate that varies between 5.8% and 7.15% depending on the income level of an individual or LLC treated as a disregarded entity.

- Corporate Income Tax: This tax is also set at a gradual rate that varies between 3.5% and 8.93% for LLCs taxed as corporations that generate more than $350,000 in annual revenue.

You can file your LLC’s income taxes online quickly and easily using the Maine Tax Portal.

Sales and Use Taxes

Sales and use taxes are collected from your customers at the point of sale and then remitted to the state governments. In Maine there are a variety of different tax rates that apply to specific categories of goods and services instead of one uniform rate.

Below, we’ve outlined the main groups of taxable items and services and their corresponding tax rate:

- General Sales: Most everyday transactions are covered by a flat rate of 5.5%. This rate is applied to the sale and use of most tangible personal property and services within Maine.

- Lodging Rentals: A flat tax rate of 9% is charged on the price of short-term accommodations in the state, such as motels and hotels.

- Prepared Food and Alcoholic Drinks: Establishments licensed to sell these goods must levy sales tax at a higher rate of 8%.

- Service Provider Tax: A sales tax rate of 6% is applied to certain specific business activities performed in Maine, such as ancillary services, telecommunications services, and home support services.

- Short Term Auto Rentals: Rentals of cars and vans in the short-term have a sales tax rate of 10% applied at the point of sale.

After registering with Maine Revenue Services, your LLC will need to submit a Sales and Use Tax Return every month by the 15th.

Employment Taxes

LLCs in Maine that hire any employees are also subject to two additional statewide taxes:

- Withholding Tax: Similar to at a federal level, employers in Maine are required to deduct state income tax from the earnings of their employees and submit these withholdings to Maine Revenue Services. Tax should be withheld at a rate that mirrors what the employee would pay in personal income tax.

- Unemployment Insurance (UI) Tax: Your LLC will need to pay UI tax on the first $12,000 earned by each employee. If you’re a new employer, UI tax is applied at a combined rate of 2.19%, otherwise UI tax is applied at a rate that varies between 0.22% and 5.69% depending on your LLC’s experience rating.

Both of these employment taxes must be filed every quarter, which can be done online using the Maine Tax Portal.

Property Taxes

If your LLC owns any real property like land, buildings, or even certain types of equipment, it will likely need to pay property taxes. In Maine these are administered by local municipalities, which will assess the total market value of your LLC’s property in accordance with the Maine Constitution.

This value is then used as a basis for calculating your tax bill by applying the local property tax rate in effect in the area. To get a better idea of how property tax will work for your business, you can get in contact with the relevant officials in your municipality using Maine’s municipal directory or employ the help of an accountant.

Keep in mind that, in addition to the applicable taxes from the list above, your LLC will be required to pay certain federal taxes regardless of where it’s registered. This often includes corporation and employer taxes — for LLCs taxed as C corporations — and income and self-employment taxes (for LLCs taxed as pass-through entities).

Steps After LLC Formation

Read all the steps you’ll need to maintain your LLC’s personal liability protection, open a business bank account, get business insurance, and stay up to date with state reporting requirements.

Visit our After Forming an LLC guide to learn more.