How to Start an LLC in Michigan (2024 Guide)

Wondering how to start an LLC in Michigan?

To get started, you'll need to pick a suitable business name, choose a registered agent, and file your Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs ($50 processing fee).

You can do this independently, consult with a business attorney for specialized legal guidance, or join the other 65% of our readers and hire a specialized Michigan LLC formation service (recommended).

How to Form an LLC in Michigan in 6 Steps

In order to form your LLC in Michigan, you will need to complete the following steps:

- Choose Your LLC Name

- Choose a Resident Agent

- File Your Articles of Organization

- Create an LLC Operating Agreement

- Obtain an EIN

- File a Beneficial Ownership Information Report

Step 1: Name Your Michigan LLC

Before you get started, you will need to pick a suitable name for your Michigan LLC.

This will need to comply with all applicable Michigan naming requirements and be both succinct and memorable, as this will make it easily searchable by your potential clients.

1. Important Naming Guidelines for Michigan LLCs:

- Your name must include the phrase “limited liability company” or one of its abbreviations (LLC or L.L.C.) and cannot include “corporation,” “incorporated,” or one of their abbreviations (“corp,” “inc,” etc.). Low-profit limited liability companies must include “low-profit limited liability company” or one of its abbreviations (L3C, l.3.c., etc.).

- Your name cannot include words that could confuse your LLC with a government agency (FBI, Treasury, State Department, etc.).

- Your name cannot include restricted words (e.g., adjuster, bank, academy, etc.) according to Michigan law unless certain regulatory criteria have been met.

- Your name cannot include words that imply that it conducts business other than that listed in its Articles of Organization.

Keep in mind that if you want to operate under one or more names other than your registered name, a Certificate of Assumed Name (Form SCL/CD 541) must be filed with the Michigan Department of Licensing and Regulatory Affairs Corporations, Securities & Commercial Licensing Bureau.

For a complete list of naming rules in Michigan, we recommend checking out the Michigan Department of Licensing and Regulatory Affairs website.

2. Is the name available in Michigan?

To check whether your desired name is already taken by another business entity in Michigan, you can search for a business entity on the Michigan Department of Licensing and Regulatory Affairs (LARA) website.

If you’re not going to start your LLC right away, it might be a good idea to consider reserving your name. You can do this for up to six months.

For more information, see our Michigan LLC Name Search guide.

3. Is the URL available?

We recommend that you check to see if your business name is available as a web domain. Even if you don't plan to create a business website right away, this is an extremely important step as it will prevent others from acquiring it – potentially saving you both time and money in the long term.

Once you have verified your name is available, you may now select a professional service to complete the LLC formation process for you.

Subscribe to our YouTube channel

We reviewed and ranked the best LLC services. Find out which is best for you.

FAQ: Naming a Michigan LLC

LLC is short for “limited liability company.” It is a simple business structure that offers more flexibility than a traditional corporation while providing many of the same benefits. Read our What is a Limited Liability Company guide for more information.

Or, watch our two-minute video: What is an LLC?

You must follow the Michigan LLC naming guidelines when choosing a name for your LLC:

- Include the phrase "limited liability company" or one of its abbreviations (LLC or L.L.C.).

- Do not use words that could confuse your business with a government agency (FBI, State Department, CIA, etc.).

- Receive the proper licensing when using the words such as lawyer or doctor.

If you are having trouble coming up with a name for your LLC, use our LLC Name Generator. That will not only find a unique name for your business but an available URL to match.

Most limited liability companies (LLCs) in Michigan do not need an assumed name, known more generally as a DBA name. The name of the LLC can serve as your company’s brand name and you can accept checks and other payments under that name as well. However, you may wish to register a DBA if you would like to conduct business under another name.

To learn more about DBAs in your state, read our How to File a DBA guide.

Yes, Michigan allows the registration of PLLCs. A PLLC (professional limited liability company) is an LLC where at least one member is licensed by the state to perform a professional service (e.g., dentists, attorneys, surgeons, etc.).

Step 2: Choose a Resident Agent in Michigan for Your LLC

After you find the right name for your LLC, you will need to nominate a Michigan resident agent. This is commonly known as a registered agent in states other than Michigan.

What is a resident agent? A resident agent is an individual or business entity responsible for receiving important tax forms, legal documents, notice of lawsuits, and official government correspondence on behalf of your business. You can think of your registered agent as your business's primary point of contact with the state.

Who can be a resident agent? A resident agent must be a resident of Michigan or a foreign corporation authorized to conduct business in the state of Michigan, such as a registered agent service. You can also choose to elect an individual within the company (e.g., yourself, etc.) or use a business attorney instead.

Under Section 450.4207 of the Michigan Limited Liability Company Act, your LLC will need to file an annual statement with the state government that contains your resident agent’s name and the address of their registered office in Michigan. The deadline for this statement is February 15 every year, except for LLCs that were formed after September 30 the year before.

Section 450.4103 of the same Act requires this statement to be signed by a manager, member, or any other agent authorized to sign on your LLC’s behalf.

Get Free Registered Agent Services

Form an LLC with Northwest Registered Agent to get one year of registered agent services free of charge.

FAQ: Nominating a Registered Agent

Yes. You or anyone else in your company can serve as the resident agent for your LLC. Having said that, this usually isn’t recommended for small business owners as a registered agent service will maintain your privacy and save you time.

Read more about being your own resident agent.

Using a professional registered agent service is an affordable way to manage government filings for your LLC. For most businesses, the advantages of hiring a professional registered agent service significantly outweigh the annual costs.

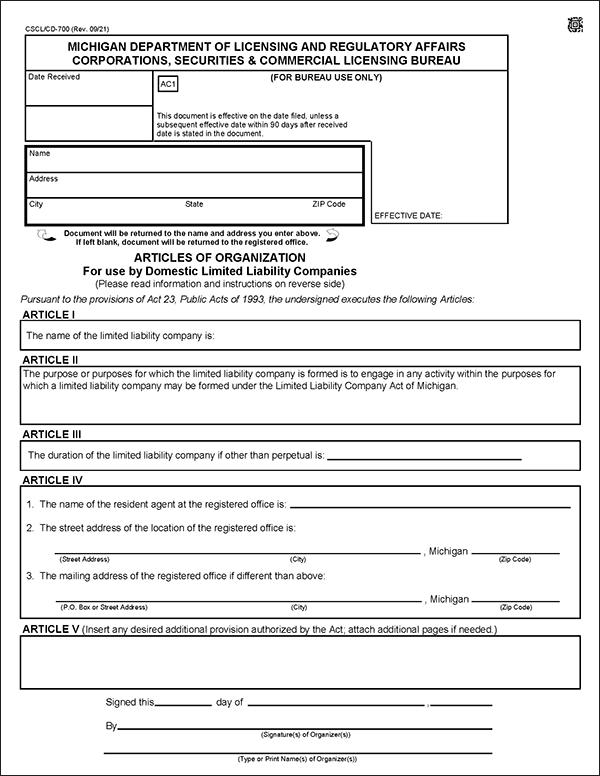

Step 3: File Your Michigan LLC Articles of Organization

To register your Michigan LLC, you'll need to file Form 700: Articles of Organization with the Michigan Corporations Division. You can do this online, by mail, or in person.

Before filing, make sure you have the information needed to complete your Certificate of Formation correctly. To file, you will need:

- The name of your business entity

- The purposes you formed an LLC for

- The duration of your LLC (if it’s not perpetual)

- The name and mailing address of the resident agent

- Any desired additional provisions

File the Michigan LLC Articles of Organization

OPTION 1: File Form 700 Online With the LARA Corporations Online Filing System

File Online- OR -

OPTION 2: File by Mail or in Person

Download FormState Filing Cost: $50, payable to the Michigan Department of Licensing and Regulatory Affairs (nonrefundable). Veterans may qualify for free filing*

Mailing Address:

Michigan Department of Licensing and Regulatory Affairs

Corporations, Securities & Commercial Licensing Bureau — Corporations Division

P.O. Box 30054

Lansing, MI 48909

Office Address:

Michigan Department of Licensing and Regulatory Affairs

2501 Woodlake Cir.

Okemos, MI 48864

Keep in mind that Michigan allows veterans to waive certain filing fees, though the exact requirements differ slightly depending on the business entity type:

- Limited Liability Companies (LLCs): All fees, including those for annual statements and reports, can be waived with a written statement demonstrating that the majority of an LLC’s membership interests are held by veterans.

- Professional LLCs (PLLCs): The same rules apply to LLCs and PLLCs, except that for PLLC annual reports and statements, the waiver covers only the $75.00 filing fee and does not include the $50.00 late filing penalty fee.

- Profit Corporations: Most fees, except for the initial Articles of Incorporation and late penalties, can be waived with a statement showing that the majority of the corporation’s shares are held by one or more honorably discharged veterans.

- Non-Profit Corporations: Only the initial Articles of Incorporation fees can be waived. This is done by submitting an affidavit certifying that the majority of the initial members, directors, or shareholders are honorably discharged veterans or individuals separated under honorable conditions.

You’ll need to prove your veteran status by providing an original or photocopy of any of the following documents:

- A DD214 form

- Form NGB FM 22 or 23

- WD AGO Forms

- A VA Veteran Health Identification Card

- A DD-2 card

- A Michigan driver’s license or ID card with a Veteran designation, or other similar documents.

For help with completing the form, visit our Michigan Articles of Organization guide.

If you're expanding your existing LLC to the state of Michigan, you will need to form a foreign limited liability company.

FAQ: Filing Michigan LLC Documents

Processing takes 24 hours online and three to five business days by mail. You can expedite your filing for an additional fee.

- 24-Hour Processing: $50

- Same-Day Processing: $100

- Two-Hour Processing: $500

- One-Hour Processing: $1,000

An LLC is referred to as a "domestic LLC" when it conducts business in the state where it was formed. A foreign limited liability company must be formed when an existing LLC wishes to expand its business to another state.

The cost to start a Michigan LLC is $50.

To learn more, read our guide on the cost to form a Michigan LLC.

Step 4: Create a Michigan LLC Operating Agreement

An operating agreement is not required for an LLC in Michigan, but it's a good practice to have one.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all LLC owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our Michigan LLC operating agreement guide.

FAQ: Creating a Michigan LLC Operating Agreement

No. The Michigan LLC operating agreement is an internal document that you should keep on file for future reference. However, many states do legally require LLCs to have an operating agreement in place.

Step 5: Get an EIN for Your Michigan LLC

You can get an Employer Identification Number (EIN) from the IRS for free. It is used to identify a business entity and keep track of a business’s tax reporting. It is essentially a Social Security number (SSN) for the company.

Why do I need an EIN? An EIN number is required for the following:

- To open a business bank account for the company

- For federal and state tax purposes

- To hire employees for the company

Where do I get an EIN? An EIN is obtained from the IRS (free of charge) by the business owner after forming the company. This can be done online or by mail.

FOR INTERNATIONAL APPLICANTS: You do not need an SSN to get an EIN. Learn more here.

Get an EIN

Option 1: Request an EIN from the IRS

- OR -

Option 2: Apply for an EIN by Mail or Fax

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

FAQ: Getting an EIN

A SSN is not required to get an EIN. You can simply fill out IRS Form SS-4 and leave section 7b blank. Then call the IRS at (267) 941-1099 to complete your EIN application. Learn more about applying as an international applicant.

Any LLC that has employees or that isn’t a single-member LLC (i.e., doesn’t have more than one member) must have an EIN. This is required by the IRS.

Learn why we recommend always getting an EIN and how to get one for free in our Do I Need an EIN for an LLC guide.

When you get an EIN, you will be informed of the different tax classification options that are available. Most LLCs elect the default tax status.

However, some LLCs can reduce their federal tax obligation by choosing the S corporation (S corp) status. To learn more, read our LLC vs. S Corp guide.

Step 6: File a Beneficial Ownership Information Report

Beginning January 2024, LLC owners will need to file a Beneficial Ownership Information (BOI) Report with the US Financial Crimes Enforcement Network (FinCEN). Existing LLCs can file their report any time between January 1, 2024, and January 1, 2025, while new LLCs will need to file their report within 90 days of formation.

This contains similar information to that of your Articles of Organization, such as your LLC name and member information, and can be filed online for free. Failure to file an accurate report on time can result in a $500 per day fine.

Note: There are certain filing exemptions, such as for large companies (i.e., more than 20 full-time employees), tax-exempt entities, and publicly traded companies.

Considering Using an LLC Formation Service?

We reviewed and ranked the top LLC formation services. Find out which is best for you.

BEST LLC SERVICESMaintain Your Michigan LLC

After you’ve successfully formed your LLC, there are a couple of steps you’ll need to periodically take in order to maintain it, including:

- Filing an annual statement

- Sorting out your tax requirements

We’ve broken down how to complete each of these steps in greater detail below.

File an Annual Statement

Michigan requires LLCs to file an annual report, known in the state as an annual statement, with the Department of Licensing and Regulatory Affairs. The deadline for this is February 15, and it can be filed online through the LARA Corporations Online Filing System (alongside a filing fee of $25).

Keep in mind that, if you form your LLC after September 30, you will not be required to file an annual statement on the due date immediately following your formation.

Note: Be sure to file your annual statement in a timely manner, as Michigan charges a $50 fee for missing the deadline.

Sort Out Your Taxes

As an LLC in Michigan, you will likely need to pay taxes at the local, state, and federal levels. Having said that, this will depend on the nature of your business (e.g., industry, niche, number of employees, etc.).

Below, we’ve broken down the most common taxes in Michigan:

Sales and Use Taxes

In Michigan, sales and use tax is imposed across the state at a flat rate of 6%. This is the amount that’s added to the price of taxable goods and services sold in Michigan that businesses collect from customers at the point of sale and remit to the state Department of Treasury.

In addition to this general sales tax rate, there are a number of specific products in Michigan that have additional rates applied at the point of sale, such as tobacco products.

Note: Before your business can start collecting sales tax, it will need to obtain a license by completing an online registration with the Michigan Department of Treasury.

Income Taxes

As an LLC based in Michigan there are three main types of income tax to be aware of:

- Personal income tax: This statewide tax is levied at a flat rate of 4.25% on the federal adjusted gross income of your LLC — this refers to the earnings you made after the IRS’s adjustments. All tax payments and returns can be completed online through the Michigan Treasury Online (MTO) platform.

- Corporate income tax: Similarly, this tax is imposed at a flat statewide rate of 6%, but does not need to be paid unless your business generates more than $350,000 in gross receipts. If you exceed this threshold, the Department of Treasury will provide you with the form needed to file an annual return — which must be filed by the final day of the fourth month following the tax year.

- Uniform City Income Tax: Cities in Michigan may impose a tax on income generated locally, usually at a rate of 1% for residents and corporations and 0.5% for non-residents — though higher rates are commonly used in larger cities like Detroit.

Business Privilege Taxes

In addition to the taxes explored above, there are a number of taxes in Michigan that levied on business for engaging in specific activities, such as:

- Airport Parking Excise Tax: A flat tax of 27% of the amount charged for public parking at a “regional” airport.

- Casino Wagering Tax: A flat tax of 19% that’s imposed on the adjusted gross receipts for permanent casinos.

- Internet Gaming Tax: A gradual tax that varies between 20% and 28% levied on the gross receipts of internet gaming providers.

Since these business privilege taxes are present at both a state and local level, your business’s tax obligations can vary depending on where it’s based.

Keep in mind that, regardless of where your LLC is registered, you will also be required to pay certain federal taxes. This includes corporation and employer taxes (for LLCs taxed as C corporations) and income and self-employment taxes (for LLCs taxed as a pass-through entity or an S corp).

Steps After LLC Formation

After forming your LLC, you will need to get a business bank account and website, sort all required business licensing, and get business insurance, among other things.

Visit our After Forming an LLC guide to learn more.