How to Start an LLC in Pennsylvania (2024 Guide)

Wondering how to start an LLC in Pennsylvania? We’ve got you covered.

To get started, you'll need to pick a suitable business name, choose a registered office, and file your Certificate of Organization with the Pennsylvania Department of State ($125 processing fee).

You can do this independently, consult with a business attorney for specialized legal guidance, or join the other 65% of our readers and hire a specialized Pennsylvania LLC formation service (recommended).

How to Form an LLC in Pennsylvania in 6 Steps

In order to form your LLC in Pennsylvania, there are certain steps you’ll need to complete:

- Name Your LLC

- Choose a Pennsylvania Registered Office

- File Your Certificate of Organization

- Create an LLC Operating Agreement

- Obtain an EIN

- File a Beneficial Ownership Information Report

Step 1: Name Your Pennsylvania LLC

Before you get started, you will need to pick a suitable name for your Pennsylvania LLC.

This will need to comply with all applicable naming requirements under Pennsylvania law and be both succinct and memorable, as this will make it easily searchable by your potential clients.

1. Important Naming Guidelines for Pennsylvania LLCs:

- Your name must include the phrase “limited liability company” or one of its abbreviations (LLC or L.L.C.).

- Your name cannot include words that could confuse your LLC with a government agency (FBI, Treasury, State Department, etc.).

- Your name must be distinguishable from any other Pennsylvania limited liability company, corporation, limited liability partnership, or limited partnership.

Pennsylvania also has a detailed list of restricted words designed to prevent misunderstandings about a business’s nature and to protect certain professions and sectors, such as:

- Banking-related terms: Terms implying banking services are restricted unless your LLC is a Pennsylvania bank holding company or meets specific criteria related to trust property.

- Insurance industry terms: Your LLC’s name cannot imply terms that imply it offers insurance services without being licensed to do so. Words like "annuity," "insurance," and similar terms are some examples of restricted terms.

- Educational implications: Terms like "college," "university," or "seminary" are restricted unless your LLC is certified by the Department of Education.

- Professional designations: Your LLC’s name cannot contain terms like "engineer," "surveyor," "architect," etc., without prior certification from the relevant professional board.

We recommend checking out the Pennsylvania General Assembly guidelines for a complete list of naming rules in the state.

2. Is the name available in Pennsylvania?

To check whether your desired name has already been taken by another business entity in Pennsylvania, you can perform a Business Search on the Commonwealth of Pennsylvania's website.

If you’re not going to start your LLC right away, it might be a good idea to consider reserving your name for up to 120 days. The filing fee for this is $70.

For more information, you can have a look at our Pennsylvania LLC Name Search guide.

3. Is the URL available?

We recommend that you check online to see if your business name is available as a web domain. Even if you don't plan to make a business website right away, this is an extremely important step as it will prevent others from acquiring it — potentially saving you both time and money in the long term.

Once you have verified your name is available, you may now select a professional service to complete the LLC formation process for you.

Subscribe to our YouTube channel

We reviewed and ranked the best LLC services. Find out which is best for you.

FAQ: Naming a Pennsylvania LLC

LLC is short for “limited liability company.” It is a simple business structure that offers more flexibility than a traditional corporation while providing liability protection for your personal assets. Read our What is a Limited Liability Company guide for more information.

Or, watch our two-minute video: What is an LLC?

You must follow the Pennsylvania LLC naming guidelines when choosing a name for your LLC:

- Include the phrase "limited liability company" or one of its abbreviations (LLC or L.L.C.).

- Do not use words that could confuse your business with a government agency (FBI, State Department, CIA, etc.).

- Receive the proper licensing when using the words such as lawyer or doctor.

If you are having trouble coming up with a name for your LLC use our LLC Name Generator. That will not only find a unique name for your business but an available URL to match.

Most LLCs do not need a DBA, known in Pennsylvania as a fictitious name. The name of the LLC can serve as your company’s brand name and you can accept checks and other payments under that name as well. However, you may wish to register a DBA if you would like to conduct business under another name.

To learn more about DBAs in your state, read our How to File a DBA guide.

A domestic limited liability company is one that is established in the state in which it operates.

Step 2: Choose a Registered Office for Your Pennsylvania LLC

After you find the right name for your LLC, you will need to nominate a Pennsylvania registered office or commercial registered office provider. This is a necessary step in completing your Certificate of Organization (i.e., the document used to file and register your LLC with the Department of State).

Keep in mind that, unlike most states, Pennsylvania does not accept individual registered agents.

What is a registered office? A registered office is the official mailing address for all legal mail from the state related to your business. Legal mail can include service of process (if you are sued) and state filings.

Where can my registered office be? Per Pennsylvania law, a registered office must be a street address within Pennsylvania. You cannot use a P.O. box. Your registered office can also be the address of a commercial registered office provider (i.e., a registered agent service).

Get Free Registered Agent Services

Form an LLC with Northwest Registered Agent to get one year of registered agent services free of charge.

FAQ: Nominating a Registered Agent

Yes. You can choose to provide your home or office street address as the registered office for your Pennsylvania LLC, however this is generally not recommended..

Read more about being your own registered office.

Using a professional registered agent service is an affordable way to manage government filings for your LLC. For most businesses, the advantages of using a professional service significantly outweigh the annual costs.

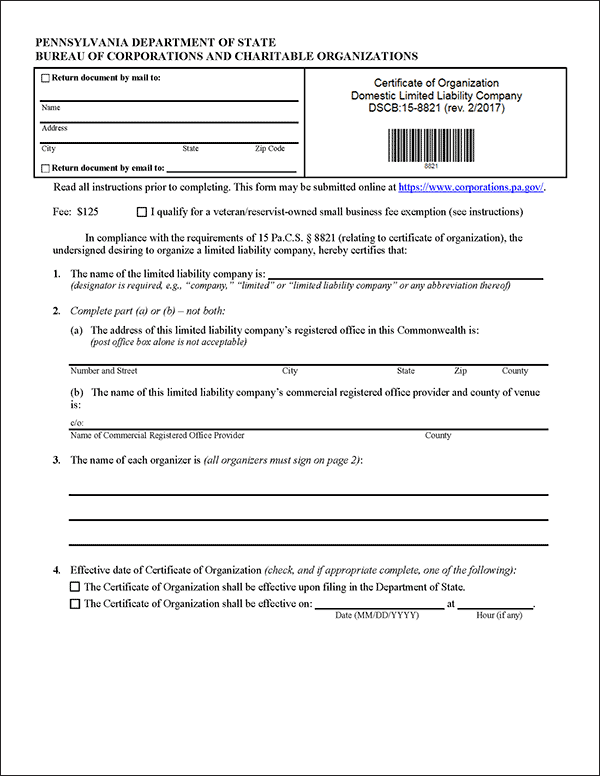

Step 3: File Your Pennsylvania LLC Certificate of Organization

To register your Pennsylvania LLC, you'll need to file a Certificate of Organization and a Docketing Statement with the Pennsylvania Department of State. You can do this online or by mail.

Before filing, make sure you have completed your Certificate of Organization correctly. You will need to have filled in the following sections:

- Your LLC’s name

- The address of your LLC’s registered office and the name of your commercial registered office provider (if applicable)

- The names and signatures of all your LLC’s organizers

- Your Certificate of Organization’s effective date (if not “effective upon filing”)

- Professional services your LLC can render (leave blank if none).

File the Certificate of Organization

OPTION 1: File Form 15-8821 Online With the Pennsylvania Business Filing Services Portal

File Online- OR -

OPTION 2: File by Mail

Download FormState Filing Cost: $125, payable to Commonwealth of Pennsylvania (Nonrefundable)

Mailing Address:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105

You’ll need to include a Docketing Statement when filing your Certificate of Organization by mail.

For help with completing the form, visit our Pennsylvania Certificate of Organization guide.

Note: If you're expanding your existing LLC to the state of Pennsylvania, you will need to form a foreign limited liability company (LLC).

FAQ: Filing Pennsylvania LLC Documents

Filing the Certificate of Organization takes two to three business days online or by mail. However, you can speed this up by filling out an Expedited Service Request, selecting one of the following options, and paying the relevant additional fee:

- Same-Day Service: $100

- Three-Hour Service: $300

- One-Hour Service: $1,000

An LLC is referred to as a "domestic LLC" when it conducts business in the state where it was formed. A foreign LLC must be formed when an existing LLC wishes to expand its business to another state.

Read our What Is a Foreign LLC article to learn more.

It will cost $125 to file your Certificate of Organization with the Pennsylvania Department of State, regardless of whether you submit it online or by mail.

To learn more, read our guide on the cost to form a Pennsylvania LLC.

Any LLCs that perform certain professional services must register as a restricted professional LLC in the state of Pennsylvania. Examples of restricted professional services include law, public accounting, psychology, veterinary medicine, or medicine and surgery.

When filing your Certificate of Organization, you must include a statement that describes the restricted service or services your company provides.

Step 4: Create Your Pennsylvania LLC Operating Agreement

An operating agreement is not required in Pennsylvania, but it's a good practice to have one.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all LLC members are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our Pennsylvania LLC operating agreement guide.

FAQ: Creating a Pennsylvania LLC Operating Agreement

No. The operating agreement is an internal document that you should keep on file for future reference. However, many other states do legally require LLCs to have an operating agreement in place.

Step 5: Get an EIN for Your Pennsylvania LLC

You can get an Employer Identification Number (EIN), also known as a Federal Identification Number or Federal Employer Identification Number, from the IRS for free. It is used to identify a business entity and keep track of a business's tax reporting. It is essentially a Social Security number (SSN) for the company.

Why do I need an EIN? An EIN number is required for the following:

- To open a business bank account for the company

- For federal and state tax purposes

- To hire employees for the company

Where do I get an EIN? An EIN is obtained from the IRS (free of charge) by the business owner after forming the company. This can be done online or by mail.

FOR INTERNATIONAL APPLICANTS: You do not need an SSN to get an EIN. Learn more here.

Get an EIN

Option 1: Request an EIN from the IRS

- OR -

Option 2: Apply for an EIN by Mail or Fax

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

FAQ: Getting an EIN

An SSN is not required to get an EIN. You can simply fill out IRS Form SS-4 and leave section 7b blank. Then call the IRS at (267) 941-1099 to complete your application. Learn more here about applying as an international applicant.

All LLCs with employees, or any LLC with more than one member, must have an EIN. This is required by the IRS.

Learn why we recommend always getting an EIN and how to get one for free in our Do I Need an EIN for an LLC guide.

When you get an EIN, you will be informed of the different tax classification options that are available. Most LLCs elect the default tax status.

However, some LLCs can reduce their federal tax obligation by choosing the S corporation (S corp) status. To learn more, read our LLC vs. S Corp guide.

Step 6: File a Beneficial Ownership Information Report

Beginning January 2024, LLC owners will need to file a Beneficial Ownership Information (BOI) Report with the US Financial Crimes Enforcement Network (FinCEN). Existing LLCs can file their report any time between January 1, 2024, and January 1, 2025, while new LLCs will need to file their report within 90 days of formation.

This contains similar information to that of your Articles of Organization, such as your LLC name and member information, and can be filed online for free. Failure to file an accurate report on time can result in a $500 per day fine.

Note: There are certain filing exemptions, such as for large companies (i.e., more than 20 full-time employees), tax-exempt entities, and publicly traded companies.

Considering Using an LLC Formation Service?

We reviewed and ranked the top LLC formation services. Find out which is best for you.

BEST LLC SERVICESHow to Maintain Your LLC

After you’ve successfully formed your LLC, there are a couple of steps you’ll need to periodically take in order to maintain it, including:

- Filing an annual report

- Sorting out your taxes

We’ve broken down how to complete each of these steps in greater detail below.

File the Annual Report

Starting in 2025, LLCs based in Pennsylvania will be required to submit an annual report to the Department of State along with a $7 filing fee. The purpose of this report is to keep the Department’s records on your LLC up-to-date, particularly regarding:

- Your LLC’s name

- Where it was formed

- Your registered office’s address

- The name of at least one governor (e.g., manager, member, or director)

- The address of your LLC’s principal office

- The entity number issued by the Pennsylvania Department of State

For LLCs, this annual report will be due by September 30 each year. From 2027 onwards, any business entities that fail to file within six months of this due date will be subject to administrative dissolution.

Note: If your LLC is dissolved for failing to make the required annual report, it can be reinstated at any time by payment of both the reinstatement application fee and any unpaid fees for overdue annual reports.

Sort Out Your Taxes

Regardless of where your LLC is registered, you will be required to pay certain federal taxes. This includes corporation and employer taxes (for LLCs filing as a C corporation) and federal income tax and self-employment taxes (for LLCs taxed as pass-through entities).

In addition, there are a number of different taxes you’ll be required to pay at a local and state level, which can vary depending on the nature of your business.

Below are some of the most common taxes in Pennsylvania:

Income Taxes

As an LLC owner based in Pennsylvania, there are certain statewide income taxes you may be required to pay in addition to any federal obligations, including:

- Personal Income Tax: Income tax in Pennsylvania is applied at a personal rate of 3.07% to individual incomes and default-structure LLCs (i.e., those opting for pass-through taxation, etc.).

- Corporate Net Income Tax: Corporations and LLCs that have not elected pass-through taxation are subject to a flat rate of 8.99% on their business’s net taxable income, which is equal to its gross income minus any allowable deductions and exemptions. Note that this rate is projected to decrease to 8.49% from January 1, 2024 onwards.

Note: While you’re also able to pay your LLC’s income taxes by phone and mail, many business owners find it far easier to do so online through the Department of Revenue’s myPATH system.

Sales and Use Taxes

If your LLC engages in the sale of goods or services within Pennsylvania, it will most likely be required to collect sales tax from customers. In Pennsylvania, this is imposed at a general statewide rate of 6%, with counties able to increase this up to a maximum of 8% with local option sales taxes.

All sales taxes you collect from customers must be remitted to the Pennsylvania Department of Revenue. While this is typically done on a quarterly basis, your filing frequency can vary depending on your sales tax liability from the previous year.

Note: In order to be able to collect and remit sales/use tax to the Department of Revenue, you’ll first need to obtain a Sales Tax License by completing an Online Business Tax Registration with myPATH.

Property Tax

Like most other states, your LLC will likely need to pay property taxes if it owns any real estate in Pennsylvania. However, the size of your property tax bill will depend on your exact location in the state, as tax rates and property values vary between individual cities and counties.

The value of the property, as assessed by local tax authorities, forms the basis for calculating these taxes. For example, the real estate tax for properties in Philadelphia in 2022 included a city tax of 0.6317% and a school district tax of 0.7681%, collectively totaling a tax rate of 1.3998%.

Note: The Department of Revenue’s district offices offer assistance with Property Tax/Rent Rebate applications free of charge.

Steps After LLC Formation

After forming your LLC, you will need to get a business bank account and website, sort all required business licensing, and get business insurance, among other things.

Visit our After Forming an LLC guide to learn more.